What is a TWC Form?

A TWC form, or Texas Workforce Commission form, is a special type of form business owners and/or employers (including representatives) use in filing their tax reports and payments.

The TWC form is sometimes referred to as a Payment Voucher form (C-3V). In this scenario, the form is completed by an employer, or any of its authorized representatives, granted a hardship waiver on file by the Texas Workforce Commission.

The waiver granted by the TWC permits the employer and/or representatives to file their tax report online and subsequently make their tax payments either by money order or check.

Information Required on a TWC Form

When completing a TWC form, you will be required to provide the following information;

Names: Enter your legal name as contained on your birth certificate and when you registered with the TWC.

Name of Company: Input the name of your company in the appropriate field in the TWC form, especially if you are completing the form as an employer or business.

Telephone Number: Provide a telephone number you can be reached at, preferably yours.

Address: Enter your address. This can be your permanent or residential address.

As an employer or business completing the TWC form, it is recommended you input your company's physical address.

TWC Account Number: This is an essential requirement of the TWC form. In the field provided in the form, you need to enter your account number associated with your TWC account.

Total Tax Payment: As an employer or employee, you are required to provide accurate details about the total amount of money you have paid as tax.

Name of Grantor: This information is required when you authorize an individual, employer or business to act on your behalf. Therefore, your name, as the grantor, authorizing the representative has to be entered in the space provided.

Relationship of Grantor: This seeks to know the relationship between you and the representative acting on behalf. The acting representative may also be another individual, employer, or business.

How to Complete a TWC Form

Have you downloaded the form but are still oblivious of how it should be filled? Have a look at this.

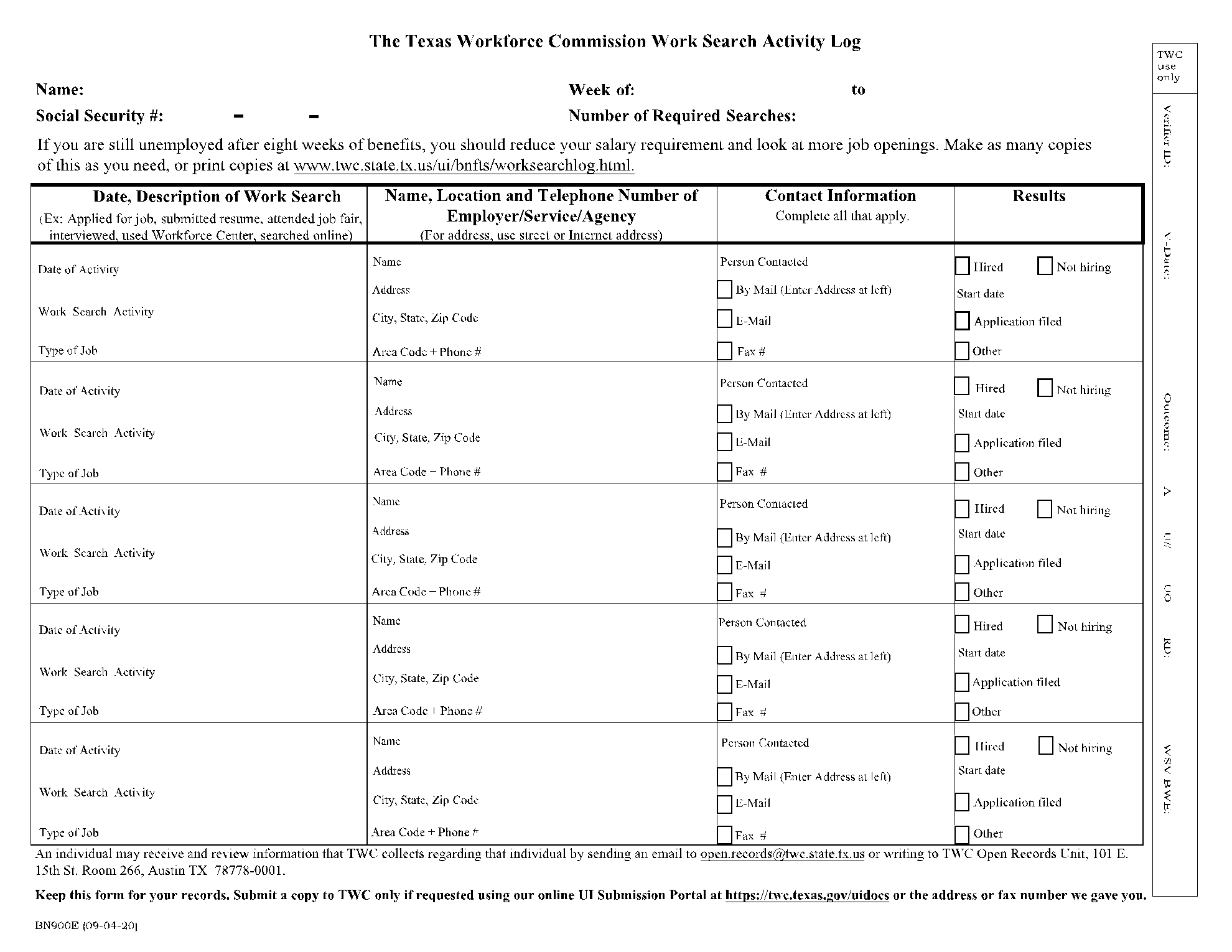

Begin by entering your name, social security number, number of required searches, and the number of weeks you have been job hunting

In the date and description of the work search column, fill in the Date of activity and Work Search activity. The date of activity talks about the day you carried out a particular activity (e.g attend job interviews) while work search activity describes the activities carried out in search of a job. For instance, how many interviews did you attend? How many job fairs did you attend in order to network with people?

Finally, fill in the Type of job field. Here, you are expected to enter what kind of job vacancies you applied for.

In the Name, location, and telephone number of employer column, fill in the following: Your name, address, city, state, zip code, area code and phone number through which you can be accessed.

Enter the name of the person contacted, their email and fax number in the Contact Information.

What results did this job search activity produce? Were you hired, did the company rescind their decision to hire anyone or was your application filed? Indicate this. Otherwise, write out in full the result of this work search activity

What is a TWC Form Used For?

A TWC form can be used in the following ways;

Discontinuation of Employment or Business: A TWC form can be used by an employer or business owner to notify the Texas Workforce Commission that it will be stopping business operations in the state of Texas. Also, the employer or business will not provide employment opportunities nor will it file quarterly contributions and wage reports after the stipulated date on the form.

Employer's Wage Statement: A TWC form is used by an employer, as required by the Texas Workers Compensation Act and Worker's Compensation, to provide an Employer's Wage Statement to its workers' compensation insurance carrier (carrier) and its claimant or the claimant's representative, if any.

Calculate Average Weekly Wage (AWW): The TWC form can be used to provide an employee's wage statement to the workers' compensation insurance carrier for calculating the employee's Average Weekly Wage (AWW) to establish benefits due to the employee or a beneficiary.

Request for Records: A TWC form can be used to make requests for records such as

- Personal (individual) Records

- Business Entity Records

- Wage Records

- Employer Tax Reports

- Unemployment Insurance

- Payday Wage Claim

- TWC Civil Rights Records (CRD)

Who Needs a TWC Form?

There are different reasons a TWC form may be needed.

You: You may need to complete a TWC form to request your personal records relating to your unemployment insurance.

Your Representative: Your representative whom you have authorized to act on your behalf will need to complete a TWC form. They will need to indicate that they have written authorization from you to represent you.

Your Attorney: An attorney representing you will also be required to complete a TWC form before they can have access to your confidential records as their client. This request will be indicated in the form.

Law Enforcement or Public Officer: A law enforcement or public officer will need to complete a TWC form before they can have access to your records. They will be required to state that they have appropriate authority to obtain the records.

Employer or Business: As an employer or business owner, you will need to complete a TWC form in order to access your business' confidential records.

Additional Resources

https://twc.texas.gov/domestic-employment-forms

https://twc.texas.gov/employers-registration-forms-status-report-form-c-1-c-1fr

https://twc.texas.gov/businesses/employers-quarterly-wage-report-filing-options

https://twc.texas.gov/payment-voucher-form-c-3v

https://twc.texas.gov/changes-status-your-business

https://twc.texas.gov/tax-law-manual-chapter-5-reports-and-records-6

https://www.twc.texas.gov/payment-voucher-form-c-3v#whoCanUseThisForm